Committee of Supply (Speech 1) by Mr Tharman Shanmugaratnam, Deputy Prime Minister, Minister for Finance & Minister for Manpower, 05 March 2012, 1.30pm, Parliament

-

Mr Chairman, Sir, I would first like to thank Members for their very useful observations and questions so far.

- I would like first to address the questions related to retirement adequacy and the CPF while MOS Tan Chuan Jin and Senior Parliamentary Secretary Hawazi Daipi will respond on the other important matters raised.

(I) Providing for Retirement Adequacy through the CPF

- Mr Zainudin Nordin, Mr Yeo Guat Kwang, Mr Seng Han Thong and Mrs Lina Chiam had raised relevant issues concerning retirement adequacy, particularly as Singaporeans live longer. Some questions were raised during the Budget Debate as well, by Ms Mary Liew and others.

- How well does the CPF system provide Singaporeans for their retirement? The short answer is that for the current generation of older Singaporeans, as I mentioned in my Budget Statement, cash savings are low for many. At the same time, the majority have significant wealth in their homes. On the other hand, for the younger generation, and especially for those in the middle and lower-income groups that the CPF system is principally aimed at serving, their CPF savings provides significantly higher income for their retirement. They would get an income in retirement at a level comparable to the median for OECD countries, even without taking into account the fact of higher home ownership in Singapore.

Is the Minimum Sum Too High?

- The CPF aims to help Singaporeans save up enough to meet a basic level of needs in retirement. The Minimum Sum (or MS) that is to be set aside at age 55 is set at a level necessary to meet the typical expenditure needs of retiree households in the lower-middle income group. What in practice does this mean? It should cover the needs of those in the 2nd quintile of income, i.e. between the 20th percentile and 40th percentile of households by incomes. It would therefore also cover the needs of those in the lower, first quintile.

- For middle-income households too, although their spending in retirement is usually higher, the CPF will still form an important part of their retirement savings.

- However, the MS is not adequate to support the expected needs of those in higher-income households, and was not designed for that purpose. They would usually have private savings outside of the CPF to tap on. It is not the aim of the CPF to cater fully to the needs of those in this group, or those higher up. If the CPF had to support those needs, we would need much higher contribution rates or a higher CPF contribution ceiling, and a much higher Minimum Sum. That would be excessive for those in the lower half of incomes.

- Mr Seng Han Thong therefore rightly asked whether the MS is too high and unattainable for those with lower incomes. A member who is 55 today and who has the full MS in his CPF can expect to receive a monthly payout that is just enough for an average two-member retiree household in the lower-middle income group – or the 2nd quintile1. It is not uncommon for one spouse amongst such families to not have worked consistently. It is therefore prudent that the MS for an active member to be able to support the basic needs of a two-member retiree household. Bearing in mind that CPF members may also make a property pledge and withdraw sums above half of the MS, the MS is not excessive. MOM reviews this regularly. There is in fact little room to have a reduced MS for the purpose of ensuring an adequate stream of income in retirement.

Retirement Adequacy: Younger Workers

- Let me now turn to the question of whether our CPF system will provide adequate retirement income or today’s younger workers, and for future generations. Will the MS be unattainable for many, like it is for many in the older generation?

- The percentage of active CPF members who meet their MS at 55 has been improving over the years, from 36% in 2007 to 45% in 2011. This will improve with each successive cohort, as educational profiles improve and their lifetime incomes rise.

- Amongst those starting work today, about 70% - 80% should be able to attain the current level set for the MS in cash, by the time they retire, adjusted for inflation, even after they have withdrawn money for a home. So, our CPF system with current contribution rates is broadly appropriate for most of the younger generation of Singaporeans.

- During the budget debate, Ms Mary Liew cited an academic study2 which showed that income replacement rates in retirement, in other words, retirement payouts compared to pre-retirement income, were low. Those low rates were however for a worker in the upper middle income level (the 70th to 80th percentiles). As I mentioned earlier, it is not the purpose of the CPF to cater fully to the needs of better-off Singaporeans. Our own projections showed that for the median and the bottom half of Singaporeans, income replacement rates for younger workers, once they retire, will be comparable to the OECD average (we will be publishing an Occasional Paper on this not too long from now).

- I should add that for those at the higher end of incomes, we have the Supplementary Retirement Scheme (SRS). This is mainly helpful for those in the upper third of incomes especially, as they enjoy tax deductions. In last year's Budget, we had raised the yearly cap on the amount of savings one may save under the SRS to $12,750. A member who consistently saves the maximum amount over 30 years will be able to set aside almost $400,000, not counting any interest or investment gains he may make on these savings.

- I should add that for our younger lower wage workers, a further source of retirement assets comes from our housing grants, which will allow them to own a home that can grow in value. The vast majority of Singaporean households in the bottom 20% of incomes own their own homes. This is a key feature of our social security system. Unlike most countries, our low-income group owns an asset that is able to grow in value as our economy grows, and which they can monetise in their retirement years if necessary. As I have shown, however, for our younger cohorts, monetisation may often not be necessary as their CPF savings in cash will itself yield a stream of income for retirement.

- 15. Plus, they get the Workfare Income Supplement (WIS). For a low-income worker who starts off at $1,200 a month, WIS will raise his CPF savings by about $35,000 (in today's dollars), by the time he reaches age 65. This is not a small sum.

- One of our tasks in MOM as we go forward is therefore to ensure that most low-wage workers are in the CPF system. If they are in casual jobs and are not receiving CPF from their employers as they should, they lose out on WIS and other Government top-ups to their CPF from time to time. SPS Hawazi Daipi will talk about this later, on how we are stepping up our enforcement and promotion efforts to ensure compliance with the CPF Act.

(i) Current Elderly

- Mr Yeo Guat Kwang, Mr Zainudin Nordin, Mr Seng Han Thong and Mrs Lina Chiam had raised the issue of today's generation of older Singaporeans.

- The CPF balances of older Singaporeans are much lower than what we will see for future generations. There are several reasons.

- First, wages were much lower 20 or 30 years ago. Amongst the women, labour force participation was also far lower.

- Second, and a very important factor, is that older Singaporeans invested a larger part of their CPF savings in their homes. For much of their working lives, 80% or so of their CPF contributions could be used for housing. We have moderated this to less than two-thirds today, so as to provide more for retirement and healthcare needs.

- Third, our older Singaporeans were in the past not required to set aside as much savings in their CPF accounts when they turned 55. A person turning 65 this year would have had to set aside only $70,000 as his Minimum Sum. And for those who did not meet their Minimum Sum, which would have been the majority of members, they were still allowed to withdraw at least half of their CPF balances in cash at age 55 under the 50% withdrawal rule. Some of our older members (those aged beyond 72 today)3 were able to withdraw all their CPF balances by pledging their property. For all these reasons, the amount of savings retained in the CPF accounts of older Singaporeans was low.

- The CPF has however helped this generation of older Singaporeans own their homes, and most have fully paid up their housing loans. They therefore have substantial CPF savings in their homes. This is why we want to give them more support to unlock the savings in their homes and supplement their retirement income.

- Some retirees rent out a spare room, especially after the children have moved out. To add to their options, we have introduced the Silver Housing Bonus (SHB) and enhanced the Lease Buyback Scheme. MND is also building more studio apartments, many of them in mature housing estates, and at the same time introducing the new Aging-in-Place Priority Scheme so that our elderly can live near family and friends.

- Many older Singaporeans do not need to take advantage of these schemes. Two-thirds of those aged 65 and above receive a monthly allowance from their family, which reflects well on the state of family support. This is also without counting the support that those in the lower income group get from various community sources or through various Government transfers. But as our society ages, we must be prepared. The demand for different ways to convert savings in the home into a source of retirement income will grow.

(ii) Women

- SMS Grace Fu (during the Budget Debate) and Mrs Lina Chiam highlighted the needs of older women in their retirement.

- The SHB will help here significantly. For retiree couples where the husband had worked and the wife was either a homemaker or worked for shorter periods, moving from a 3 or 4 room flat to a studio apartment will provide a significant boost to their CPF LIFE payouts. If the husband was a median income earner, his RA balances would typically have been slightly above half of the Minimum Sum. Therefore, when they take advantage of the SHB scheme, they would be able to take out substantial cash proceeds too, besides obtaining higher CPF LIFE payouts.

- The CPF also encourages family support, particularly within the immediate family. For instance, the Minimum Sum Topping-Up scheme provides tax incentives for members who top up the CPF of their wives and mothers. The number of top-ups today is not large, but we are thinking of ways to improve and simplify the current schemes to encourage more top-ups.

- However, this does not solve the problem for widowed homemakers with little savings, or poor elderly couples who do not own a home as described by Mr Yeo Guat Kwang. For these groups, we must help them through ComCare which we have expanded, by providing rental flats, which MND is building more of, and by partnership with the community, which we are also doing more of.

CPF Returns and Inflation

- I now turn to the issue of returns on CPF monies. Mr Yeo Guat Kwang asked whether the value of our CPF savings can be preserved in an inflationary environment.

- We have to take a long-term perspective on CPF returns. In fact, over the long-term, CPF interest rates have provided reasonable returns, on top of inflation. Over the last 10 years, for instance, the return on Special, Medisave and Retirement Account (SMRA) monies, after accounting for inflation, was 2.5% per year4. Over the last 20 years, it was 2.2% per year, also after accounting for inflation. This was despite the extra 1% Interest on the first $60,000 of CPF balances only starting in 2008.

- The compounding effect of this extra 1% interest, on top of long term bond rates, will over the long run help shore up members' CPF savings – especially for those in the lower income group. Current interest rates are very low, because of easy monetary policies in the US. This may persist for another two years, but few people expect such low interest rates to stretch over the longer term.

- We should also bear in mind that a large proportion of CPF savings of Singaporeans is invested in housing, which is a hedge against inflation.

- If a typical 55-year old median earner considers the rate of return on his total CPF savings – comprising not only what he earns on his CPF balances but also the returns on the CPF savings he put into his house he would have experienced a total rate of return of about 6% to 8%, or 4% – 6% in real terms, per year, on average, until he reaches 55.

- So apart from the savings he gets from CPF LIFE, he can choose to realise some of the gains he has accumulated in his property through the various ways we discussed earlier. Plus, he has a place to stay in.

- We will nevertheless review our CPF system regularly to ensure it meets Singaporeans needs, especially as we live longer. This brings me to the next part of my response, where I will elaborate on CPF LIFE.

(II) Further Improvements to the CPF

A Simpler CPF LIFE

- 2013 will be a milestone for the CPF. From 1 Jan 2013, the majority of members turning 55 will join CPF LIFE, instead of the Minimum Sum Scheme. Members with balances of above $40,000 in their Retirement Accounts will be automatically included in CPF LIFE, while those with lower balances may opt in.

- CPF LIFE is a significant enhancement. The current Minimum Sum Scheme provides payouts for a limited period – slightly more than 20 years. In contrast, CPF LIFE provides Singaporeans with an income for life, doing away with the worry that savings may run out towards the end of their lives.

- In fact, for Singaporeans who are aged 65 today, about half of them are expected to live beyond 85. One-third would live beyond 90. Future cohorts of those who reach 65 will live even longer. A growing proportion of retirees would therefore outlive their CPF savings if they were on the Minimum Sum Scheme.

- CPF LIFE is therefore both an important and timely evolution of the Minimum Sum Scheme.

- There are still some misconceptions about CPF LIFE. Some people think the Government introduced CPF LIFE to hold on to their money for life. Actually, all it means is that you get paid for life under CPF LIFE, instead of about 20 years under the Minimum Sum Scheme. CPF LIFE does not change how much you can withdraw from the CPF in cash, and does not change how your savings in other CPF accounts can be used.

- Second, some people believe you will end up losing your CPF savings if you do not live long enough. When you are on CPF LIFE, you will still leave a bequest. The bequest goes to your loved ones, not to other CPF members, and not to the Government. You will get all of your capital back, either through your monthly payouts, or in a bequest left to your loved ones.

- We have had some experience operating CPF LIFE since late 2009, when members above 55 were able to opt into the scheme. About 73,000 members have signed up for CPF LIFE so far – not large compared to the total number of eligible members we have, but already equivalent to the total number of private annuities in force today5. We did not market CPF LIFE aggressively during this opt-in phase.

- Mr Seng Han Thong asked for a breakdown of the various plans that members opted for. Members chose from four plans – Plus, Balanced, Basic and Income. The plans offer different bequest levels and payouts – the higher the payout, the lower the bequest.

- The most popular plans were the Plus and the Balanced, with nearly 90% of opt-in members choosing either plan. Clearly, members preferred the features of these two plans. These include relatively high monthly payouts, but also a bequest.

- The least popular plan was the Income Plan. Few favoured its no-bequest feature.

- However, we also received feedback during this opt-in phase that members had to put significant effort into understanding and choosing from among the four plans. Yet, the payouts between the plans are not so significantly different. As Seng Han Thong said, the difference in payouts between our two most popular plans – the Plus and the Balanced – is only about 4% on average, or about $30 at the projected median balance in 2013 of $90,0006.

- Both Mr Seng Han Thong and Mr Yeo Guat Kwang asked whether we will be making enhancements to the current scheme. Learning from our experience from the opt-in phase, we will make CPF LIFE simpler for the first cohort next year. We will refine the scheme so as to bring the number of CPF LIFE plans down from four to two. It will provide simplicity, but retain the best features of the existing plans.

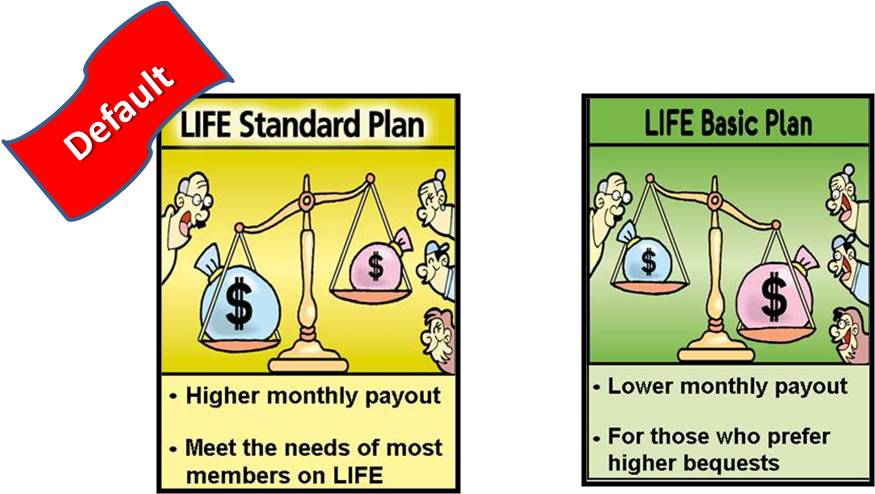

- First, we will combine the features of the Plus and Balanced Plans into a new option called the Standard Plan. The Standard Plan will also serve as the default plan - the plan that auto-included members will be placed on if they do not make a selection.

- Compared to the Balanced Plan, which was previously treated as the default for the opt-in phase, the new Standard Plan will provide slightly higher payouts. The payouts for the Standard Plan will be close to the Plus Plan. However, members on the Standard Plan will retain the flexibility in the use of their Retirement Account (RA) monies for housing between 55 and 65, just as the previous Balanced Plan allowed.

- As a second change, we will remove the Income Plan. It had not been popular, with only 3% of members choosing it during the opt-in phase. There is also a drawback of the Income Plan, in that members may choose the plan without careful consideration and regret their choice later.

- A few months into the opt-in phase, CPF Board wrote to the members who had signed up for the Income Plan to confirm their choice, highlighting once again that it did not offer a bequest. About 30% of those who had chosen the Income Plan thought again about it and changed their minds.

- Even if the member feels he is making the right decision at the time, family circumstances can change. For example, the member who may have been estranged from his child or spouse, may subsequently be reconciled, and prefer to have made a bequest.

- Yet another disadvantage of this no-bequest feature of the Income Plan was that you lose all of your savings to the LIFE fund if you pass away not long after you join the Income Plan at age 55. Even if you pass away soon after age 65, you lose most of your savings and your family gets no bequest. It is natural that the next-of-kin will be unhappy in such a scenario, when the member unfortunately passes away early. After careful consideration, we have therefore decided that as part of the simplification of CPF LIFE, we will remove this no-bequest Income Plan.

- With these changes, CPF LIFE will therefore comprise just two simple choices – the Standard Plan, which will serve as the default plan, and the current Basic Plan, which will remain unchanged. These two plans provide a meaningful choice for members.

a. The Standard Plan should meet the needs of most members. It will provide a higher payout, and a bequest. It will also give members flexibility to use their RA monies for housing until 65 years old.

b. The Basic Plan will continue to cater to members who prefer a higher bequest and are willing to accept slightly lower payouts. This plan also provides flexibility for members who wish to use their RA savings for housing even after 65 years old.

- For members who join CPF LIFE when they turn 55 next year, the transition will be a smooth one. We already have a Minimum Sum Scheme that everyone is used to, where monthly payouts begin at the draw-down age of 657, and a bequest is left for members' beneficiaries at their demise. This will continue under CPF LIFE. What CPF LIFE does is to extend the Minimum Sum Scheme to last for life, with minimal reduction in monthly payouts.

- Take the example of a CPF member who has $90,0008 in his Retirement Account at age 55. $90,000 is the median RA balance for active members in this cohort. If he were under the Standard Plan, his monthly payouts will be only 2% lower that under the Minimum Sum scheme, but he will get payouts for life. He has no risk of finding that fortunately while he lives long, he could suddenly face his income being cut off.

- This is why we introduced CPF LIFE. Members will have income for life. It will be supplemented by the fiscal schemes which we have enhanced, i.e. measures in the Budget, to support our elderly.

- These refinements to CPF LIFE will take effect from 1 Jan 2013 onwards, in time for the cohort turning 55 in 2013.

- We will engage and communicate with CPF members to help them better understand the choice they can make between the two CPF LIFE plans. Members turning 55 in 2013 will receive individualised letters a few months before they turn 55.

- Those who had already opted in to CPF LIFE will have the option to switch over to the new Standard Plan before 31 Dec 2013. They will also receive individualised letters. Those who prefer to stay on their existing plans may do so.

Tapping Post-55 Contributions to Raise Payouts

- We will also make a related change to help raise payouts.

- As Singaporeans work longer, CPF contributions made after 55 years old will become an increasingly significant component of our retirement savings. The increase in older worker CPF contribution rates further reinforces this. Members would expect such additional contributions to translate into higher monthly payouts when they reach their DDA at 65, and rightfully so.

- To help them achieve this, when a member reaches 65, we will automatically transfer his Ordinary and Special Account monies to the Retirement Account, up to the cohort Minimum Sum. This is similar to what is currently performed when a member reaches age 55.

- This change will not affect how much a member can withdraw, in cash, from their CPF accounts. Without such an arrangement, the balances may remain untapped in the OA or SA until the member’s demise, if the member does not activate a transfer himself. His OA balances would also earn lower interest rates.

(III) CONCLUSION

- The CPF, together with our public housing system, are essential pillars of our social security system. We have improved it over the years, and made it a unique system to serve the needs of our society. We will continue to build on it and strengthen it, to serve Singaporeans' needs.

1 MOM estimates. Based on ranking of resident households by their monthly household expenditure (excluding imputed rental of owner-occupied accommodation) adjusted for retirement needs per household member.

2 Associate Professor Hui Weng Tat, "Macroeconomic Trends and Labour Welfare: A Focus on Retirement Adequacy", Singapore Perspectives Conference 2012.

3 Members who reached 55 before 1 July 1995.

4 Annualised real rate of return on CPF SMRA from 2001 – 2010, with 1% Extra Interest.

5 MAS, Insurance Statistics (Q3 2011): The total number of individual annuity policies in force as of 3Q 2011 is 73,062.

6 For active members.

7 For those born in 1954 and after.

8 Projected median RA balance for active members turning 55 in 2013.