National Wages Council (NWC) Guidelines 2017/2018

Economic Performance and Labour Market in 2016

- In 2016, the Singapore economy grew by 2.0%, similar to the 1.9% growth in 2015. Total employment (excluding Foreign Domestic Workers) grew by 8,600 in 2016, lower than 23,300 in 2015. The overall unemployment rate rose slightly from 1.9% in 2015 to 2.1% in 2016, while the resident unemployment rate increased from 2.8% in 2015 to 3.0% in 2016. Redundancies rose to 19,170 in 2016, continuing an upward trend since 2010, but remained lower than the recessionary high in 2009.

- The Consumer Price Index (CPI) fell by 0.5% in 2016, similar to the decline in 2015. CPI less imputed rentals on owner-occupied accommodation (OOA), which relates more directly to the actual cash spending of households, edged up by 0.3% in 2016, slightly higher than the 0.1% increase in 2015.

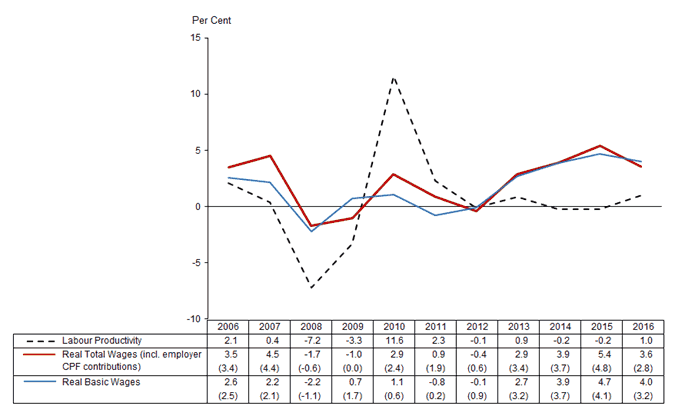

- Overall labour productivity as measured by real value-added per worker rose by 1.0% in 2016, reversing the decline of 0.2% in 2015.1

- Total nominal wages in the private sector, including bonuses and employer Central Provident Fund (CPF) contributions, grew by 3.1% in 2016, lower than the increase of 4.9% in 2015. This was due to a lower basic wage increase of 3.5% in 2016 (compared to 4.2% in 2015). Bonuses remained largely unchanged at 2.16 months of basic wages in 2016 (compared to 2.17 months in 2015).

- Accounting for the -0.5% CPI inflation in 2016, real basic wages continued to grow but at a slower pace of 4.0%, compared to 4.7% in 2015. Real total wages including employer CPF contributions rose by 3.6% in 2016, compared to 5.4% in 2015.

Outlook for 2017

- Global growth is projected to improve in 2017, although uncertainties and downside risks remain. In particular, there are signs of a rise in anti-globalisation sentiments, which could have an adverse impact on global trade if they lead to increased protectionism. In Singapore, the economic outlook remains varied across sectors. Outward-oriented sectors such as Electronics and Transportation & Storage, as well as domestically-oriented sectors such as Health & Social Services, are likely to support growth in 2017. On the other hand, sectors such as Construction, Marine & Offshore Engineering, Retail and Food Services are likely to continue to face headwinds. Against this macroeconomic backdrop, the Singapore economy is expected to grow by 1.0% to 3.0% in 2017, with growth likely to come in higher than 2.0% barring the materialisation of downside risks. The Monetary Authority of Singapore (MAS) forecasts2 the 2017 CPI inflation to be between 0.5% and 1.5%.

- Likewise, the labour market outlook is expected to remain uneven across sectors. Hiring in some sectors will remain cautious, but opportunities will continue to be available in others such as Health & Social Services, Information & Communications, Finance & Insurance, and certain segments of Manufacturing.3

NWC Wage Guidelines for 2017/2018

Deepen Skills and Transform Jobs to Enhance Productivity and Stay Future-Ready

- The NWC welcomes the recommendations made by the Committee on the Future Economy (CFE), particularly to embrace innovation, build stronger digital capabilities, and deepen international connections. With total workforce growth expected to be significantly lower (around 25,000 to 40,000 per annum) than in the earlier part of this decade, it is crucial for businesses to redesign jobs and transform towards higher productivity and innovation, so as to be manpower-lean and competitive. This will ensure that real wage increases are in line with productivity growth over the long term.

- The NWC calls on tripartite partners to press on with implementing the CFE recommendations in each sector through the Industry Transformation Maps (ITMs), to ensure that our businesses capture growth opportunities that provide good jobs and good wages for Singaporeans. The Government’s Transform and Grow initiative will provide timely support. The NWC encourages employers to tap on the support available under this initiative to create better quality jobs for Singaporeans.

- As the economy undergoes transition and businesses restructure, the Government has further enhanced the Adapt and Grow package to help affected workers to reskill and take on new jobs in the future economy. The NWC welcomes these initiatives, which will help to overcome missed matches and mismatches in the labour market. Both jobseekers and employers are encouraged to make full use of Government support to secure good job matches. The NWC also urges all workers to tap on SkillsFuture initiatives to continually refresh their skills to take advantage of opportunities in the future economy.

- Taking into consideration the uneven business conditions, and the ongoing transition of the economy, the NWC reaffirms the principle that wage increases will need to be sustainable and fair: built-in wage increases should be given in line with firms’ business prospects, while variable payments should reflect firms’ performance and workers’ contributions. Hence, the NWC recommends that:

- employers which have done well and have good business prospects should reward their workers with built-in wage increases, and variable payments commensurate with the firms’ performance;

- employers which have done well but face uncertain prospects may exercise moderation in built-in wage increases, but should reward workers with variable payments commensurate with the firms’ performance; and

- employers which have not done well and face uncertain prospects may exercise wage restraint, with management leading by example, and should make greater efforts to transform and grow.

- In doing so, the NWC encourages employers to share productivity gains fairly with workers and enhance flexibility in their wage structure to ensure competitiveness.

Wage Recommendations for Low-Wage Workers

- The NWC notes that the ongoing efforts by tripartite partners to raise the skills and incomes of low-wage workers, and support for the five rounds of NWC quantitative wage recommendations for low-wage workers, have made a positive impact. Since the quantitative guidelines were introduced in 2012, the proportion of full-time resident employees earning a basic monthly wage of up to $1,000 is estimated to have decreased from 10.6% in 2011 to 6.8% in 2014, and to 4.7% in 2016.4 The judicious increase in the wage threshold in 2015 to $1,100 has helped to maintain momentum of the effort. After the increase, the proportion of full-time resident employees earning a basic monthly wage of up to $1,100 is estimated to have decreased from 8.2% in 2014 to 5.7% in 2016. Therefore, the NWC believes there is merit to continue to provide quantitative guidelines for low-wage workers, and to further raise the basic wage threshold from $1,100 to $1,200.

- Last year, instead of a fixed absolute quantum of wage increase, the NWC recommended a built-in wage increase ranging between $50 and $65 for workers earning a basic monthly wage of up to $1,100. The greater flexibility provided by the range has increased the adoption rate of the quantitative guidelines from 18% in 2015 to 21% in 2016.5 With the labour market outlook and business conditions remaining uneven across sectors, the NWC sees merit in continuing to set a range for the recommended wage increases.

- As such, the NWC recommends that:

- employers grant low-wage workers a built-in wage increase in the form of a dollar quantum and a percentage, to give the low-wage workers a higher percentage built-in wage increase;

- employers grant a built-in wage increase of $45 to $60 for low-wage workers earning a basic monthly wage of up to $1,200; and

- employers grant a reasonable wage increase and/or one-off lump sum based on skills and productivity for low-wage workers earning above $1,200.

- The NWC will review the continued need for quantitative guidelines for low-wage workers annually, taking into careful consideration factors such as Singapore’s economic performance, competitiveness, labour market conditions, productivity performance, and progress on outcomes for low-wage workers.

Low-Wage Workers in Outsourced Work

- The NWC recognises that some low-wage workers are employed in outsourced work. As of December 2016, 49% of private establishments performing outsourced work and with employees earning a basic monthly wage of up to $1,100, gave increments equal to or more than the NWC’s recommended built-in wage increase of $50 to $65 to these employees, compared to 42% which gave increments equal to or more than the NWC’s recommended built-in wage increase of $60 in 2015. The NWC notes that the Government is taking the lead to best source and incorporate NWC wage recommendations into outsourced service contracts in these sectors. However, government procurement amounts to only a fraction of total spending on outsourced services. Hence, the NWC urges employers and service buyers of these industries to do the same.

- Service providers of outsourced services, starting with cleaning, security and landscaping services, should factor in the annual wage adjustments and the Annual Wage Supplement (AWS) for workers into new contracts, and service buyers should recognise and support such efforts, including by allowing contract values to be adjusted as necessary.

- As part of fair and progressive employment practices, the NWC recommends that service buyers and service providers take into account the experience and performance of outsourced workers when employment contracts are offered or renewed. The NWC urges service buyers and service providers to work together to ensure adequate training for and improving the employment terms of outsourced employees.

Progressive Wage Model (PWM)

- The NWC strongly supports the PWM and notes the efforts of the tripartite committees formed to advance the Government-enforced PWM in the cleaning, security and landscaping industries, covering areas of skills, productivity, career progression and wages. As of 1 September 2016, the PWM was fully implemented in the three industries. The NWC welcomes the recommendations of the Tripartite Cluster for Cleaners on progressive wages to introduce yearly wage adjustments to each wage point in the PWM from 2017 to 2019, scheduled wage increases from 2020 to 2022, and annual bonus from 2020. The NWC notes and supports the intent of the tripartite PWM cluster committees for the security and landscaping industries to make separate recommendations on wage adjustments to their PWM wage scales, to ensure employees in these industries continue to have sustainable and progressive wage increases along with industry transformation.

- The NWC notes that in addition, employers in sectors such as Public Bus Transport and Healthcare have adopted the concept of “progressive wages and skills” and provided a clear pathway for their workers to upskill and upgrade, including through structured training and participating in SkillsFuture initiatives. The NWC urges employers in other industries to do the same. PWMs, reinforced by skills upgrading and productivity improvement, will allow employers to make better use of manpower and pay higher wages, commensurate with their workers’ job scopes, responsibilities, skill sets and productivity levels.

Other NWC Recommendations

Re-Employment of Older Workers

- The NWC welcomes the move by the Government to raise the re-employment age from 65 to 67 from 1 July 2017. The NWC encourages employers to tap on Government programmes like enhanced WorkPro6 to implement age-friendly workplace practices and create easier, safer and smarter jobs for older workers aged 50 and above. The NWC notes that the Special Employment Credit (SEC)7 provides wage offset of up to 8% for employers hiring Singaporeans aged 55 and above, earning up to $4,000 a month. To provide additional support to employers hiring older Singaporeans who are not covered by the new re-employment age of 67, the Additional Special Employment Credit (ASEC) will be extended for two and a half years from 1 July 2017 to 31 December 2019. From 1 July 2017, the ASEC together with the SEC will provide employers up to 11% of wage offset when they hire Singaporeans earning up to $4,000 a month, and who are not covered by the new re-employment age.

Responsible Retrenchment

- The NWC notes that the Ministry of Manpower has made retrenchment notifications mandatory from 1 January 2017. This will help the tripartite partners to better assist retrenched locals in finding alternative employment and relevant training. Where retrenchment is inevitable, the NWC reaffirms the need for employers to do so responsibly and fairly. Employers should consult unions if the company is unionised and work with outplacement services or agencies such as Workforce Singapore (WSG) Career Centres and the Employment and Employability Institute (e2i) to assist affected employees. Retrenched workers are encouraged to tap on the Adapt and Grow and SkillsFuture initiatives for training, and reskill for new employment opportunities.

Application of NWC Guidelines

- The NWC Guidelines cover the period from 1 July 2017 to 30 June 2018.

- These recommendations are applicable to all employees – management, executives, professionals and rank-and-file employees, unionised and non-unionised companies in both public and private sectors.

- These recommendations also apply to workers who have been re-employed.

- To fcilitate wage negotiation, employers should share relevant information, such as company wage information, business performance and prospects, with unions.

- The NWC encourages employers that encounter difficulties in implementing the guidelines to work with the employers’ associations and unions, to address the issues.

Appendix

Table 1: Wage Changes in 2015 and 2016

| |

2015 |

2016 |

| Total Wages (including employer CPF contributions) |

|

|

4.9% |

3.1% |

|

|

5.4%

(4.8%) |

3.6%

(2.8%) |

| Basic Wages |

|

|

4.2% |

3.5% |

|

|

4.7%

(4.1%) |

4.0%

(3.2%) |

| Annual Variable Component (i.e. bonuses) |

2.17 months of basic wages |

2.16 months of basic wages |

Notes:

- Real wage changes are deflated by Consumer Price Index (CPI) for all items at 2014 prices (2014=100). Figures in brackets are deflated by CPI less imputed rentals on owner-occupied accommodation at 2014 prices (2014=100).

- Total wages (including employer CPF contributions) comprise basic wages, annual variable component (i.e. bonuses) and estimates of employer CPF contributions. Basic wages and annual variable component (i.e. bonuses) exclude employer CPF contributions.

Figure 1: Annual Change in Productivity and Real Wages, 2006-2016

Sources: Survey on Annual Wage Changes, Manpower Research and Statistics Department, MOM Department of Statistics, MTI (For Productivity Data)

Notes:

- Real wage changes are deflated by Consumer Price Index (CPI) for all items at 2014 prices (2014=100). Figures in brackets are deflated by CPI less imputed rentals on owner-occupied accommodation at 2014 prices (2014=100).

- Total wages (including employer CPF contributions) comprise basic wages, annual variable component (i.e. bonuses) and estimates of employer CPF contributions. Basic wages exclude employer CPF contributions.