Statement on Labour Market Developments in 2H 2020

INTRODUCTION

1. By the fourth quarter of 2020, Singapore’s labour market showed a broad improvement.Resident employment grew firmly in the third and fourth quarters, while unemployment rates and retrenchments eased in the fourth quarter.The number of job vacancies also increased, and a higher proportion of retrenched workers secured employment.

2. Notwithstanding the improvements, the impact of COVID-19 on Singapore’s labour market has been significant.For the full year of 2020, total employment registered its sharpest contraction in more than two decades.However, Government measures helped cushion the impact - resident employment continued to grow, and while unemployment rates rose, they did not exceed levels recorded in previous recessions.Even though retrenchments rose, the incidence of retrenchment was lower than previous recessions after accounting for the increase in our workforce size over the years.

3. However, resident unemployment and long-term unemployment rates are still elevated, and labour market recovery in 2021 remains surrounded in uncertainty.The extension and enhancement of the SGUnited Jobs and Skills Package announced at Budget 2021 will help to secure the rebound, and every segment of the workforce to emerge stronger.

REVIEW OF THE LABOUR MARKET IN 20201

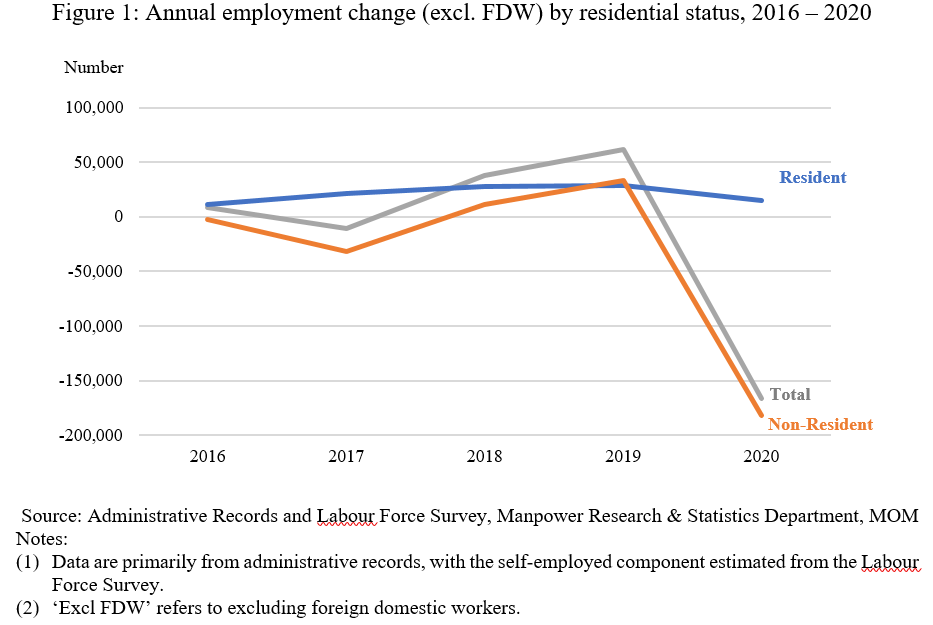

4. Total employment (excluding Foreign Domestic Workers (FDW)) contracted by 166,600 in 2020, the sharpest in more than two decades.Non-residents (-181,500) accounted for all of the employment decline.On the other hand, resident employment (+14,900) rebounded to slightly above pre-COVID levels, as a result of improvements in the second half of the year.

5. Resident employment trends were mixed across different sectors.While resident employment grew in Public Administration & Education, Health & Social Services, Information & Communications, Financial & Insurance Services and Professional Services, it posted the largest contractions in tourism and aviation- related sectors, which were severely affected by COVID-19 travel restrictions and safe-distancing measures2.

6. Non-resident employment declined in all sectors, with the bulk in Construction and Manufacturing.The decline (-181,500) was mainly driven by Work Permit & Other Work Passes (WP+) holders (-138,800), followed by decreases in S Pass holders (-26,000) and EP holders (-16,700).

7. Even though the annual average unemployment rates3 rose in 2020 compared to 2019 (overall: from 2.3% to 3.0%; resident: from 3.1% to 4.1%; citizen: from 3.3% to 4.2%), they did not exceed levels recorded in past recessionary periods of SARS (2003)4 and the Global Financial Crisis (2009)5.In the last two months of 2020, monthly unemployment rates had started to fall. The annual average resident long-term unemployment rate rose over the year from 0.7% to 1.0% in 2020, slightly higher than in 2009 (0.9%).

8. The number of retrenchments for the whole of 2020 (26,110) more than doubled that of 2019 (10,690).However, the incidence of retrenchment in 2020 (12.8 retrenched per 1,000 employees) was lower than past recessionary years (averaging 22.5 per 1,000 employees) after taking into account increases in the size of the labour force over the years.Non-residents were more likely to be retrenched (15.7 retrenched per 1,000 non-resident employees) than residents (11.1 retrenched per 1,000 resident employees).

9. Overall, the re-entry rate among retrenched residents in 2020 (62%) was slightly lower than in 2019 (64%), although there was an improvement in the final quarter of the year (3Q 2020: 57%, 4Q 2020: 64%).

10. The number of job vacancies (seasonally adjusted) rose to 56,500 in December 2020, a high last seen in March 2019.This partly reflects the government support measures to encourage hiring.The seasonally adjusted ratio of job vacancies to unemployed persons therefore also improved to 0.77 in December 2020, from 0.63 in the previous quarter.This remained below the ratio in the pre-COVID period (0.82) as unemployment remained elevated.

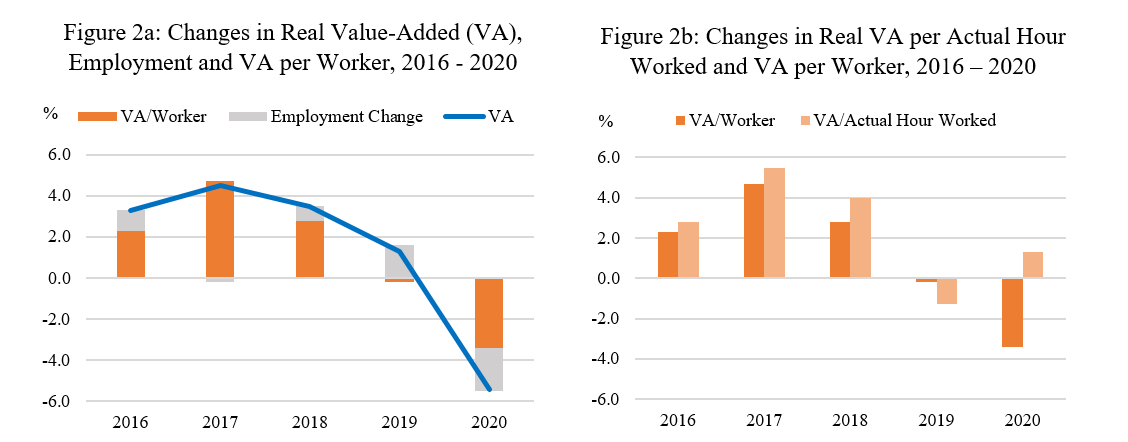

11. Labour productivity, as measured by real value-added per actual hour worked, rose by 1.3% in 2020, supported by strong productivity gains in Manufacturing, but weighed down by declines in Construction and Services (refer to Appendix for details).By contrast, real value-added per worker fell by 3.4% in 2020.The difference between measures was a result of the significant decline in the average number of hours worked per worker, against the backdrop of the Circuit Breaker measures and the subsequent phased re-opening of the economy.

LABOUR MARKET OUTLOOK

12.The Ministry of Trade and Industry (MTI) has maintained Singapore’s GDP growth forecast for 2021 at “4.0% to 6.0%”. The Singapore economy is expected to see a gradual recovery over the course of the year, although the pace of recovery is likely to be uneven across sectors. The outward-oriented sectors (e.g. trade-related services sectors and manufacturing) are projected to benefit from the pickup in external demand. Information & Communications and Financial & Insurance Services sectors are also expected to continue to post steady growth, supported by sustained enterprise demand for IT and digital solutions, and credit and payment processing services respectively. The tourism and aviation-related sectors are projected to see slower recovery due to the slow lifting of global travel restrictions as well as weak global demand for air travel.

13. However, while Singapore’s COVID-19 situation remains under control and our vaccination programme is underway, uncertainties and risks in the global economy remain.Consequently, the labour market conditions remain uncertain although we have started 2021 on a firmer footing than in 2020.Labour market recovery may be gradual and uneven across sectors.

CONCLUSION

14. While the impact of COVID-19 on the labour market situation for 2020 has been significant, there has been a broad improvement in the fourth quarter of 2020.As global economic uncertainties persist, the labour market recovery is likely to be varied across sectors.

15. To secure the rebound, the Government has extended and enhanced the SGUnited Jobs and Skills Package, which was announced at Budget 2021.We have set aside an additional $5.2 billion to extend the Jobs Growth Incentive (JGI) by seven months to support employers to expand local hiring, with enhanced support when they hire mature workers, persons with disabilities and ex-offenders.We will continue to support jobseekers’ reskilling and upskilling efforts, to help them prepare for jobs of the future and emerge stronger from the crisis. We will expand the capacity of Career Conversion Programmes to 10,000 places in 2021, and mount new programmes for in-demand jobs in growing sectors such as Manufacturing, Information Communications & Technology, and Professional Services.We have also extended the SGUnited Traineeships, SGUnited Mid-Career Pathways and SGUnited Skills programmes till March 2022, to help jobseekers who may not be able to secure a job straight away to gain industry-relevant skills and experience to boost their employability, with higher support for mature jobseekers.

16. In 2020, about 76,000 locals were placed into jobs, traineeships and attachments under the SGUnited Jobs and Skills Package.The Government and our tripartite partners remain focused on supporting jobseekers and walking with them through this crisis.To better serve jobseekers, Workforce Singapore will digitalise and expand its career matching services, and work with employment agencies with strong capabilities to provide more avenues of support for jobseekers.

FOR MORE INFORMATION

17. The “Labour Market Report 2020” is released by the Manpower Research and Statistics Department, Ministry of Manpower. The report and technical notes on the various indicators are available at http://stats.mom.gov.sg/Pages/Home.aspx.

MINISTRY OF MANPOWER

16 MARCH 2021