Statement on Labour Market Developments in 1H 2021

1. The labour market improved in the first half of 2021 as resident employment grew and unemployment continued to ease. However, the labour market recovery has been uneven across sectors, with domestically-oriented and tourism- & aviation-related sectors continuing to be impacted by COVID-19, while growth sectors such as Financial & Insurance Services, Professional Services and Information & Communications saw sustained demand for manpower. As a result of this demand and manpower shortages from border restrictions, the number of job vacancies rose to a record high, and the ratio of job vacancies to unemployed persons increased to above 1 for the first time since March 2019. Resident unemployment rates continued to decline, but remain elevated compared to pre-COVID-19 levels. Through the SGUnited Jobs and Skills Package, the Government has been supporting locals to be placed into jobs and skills opportunities.

Review of the Labour Market in 1H 20211

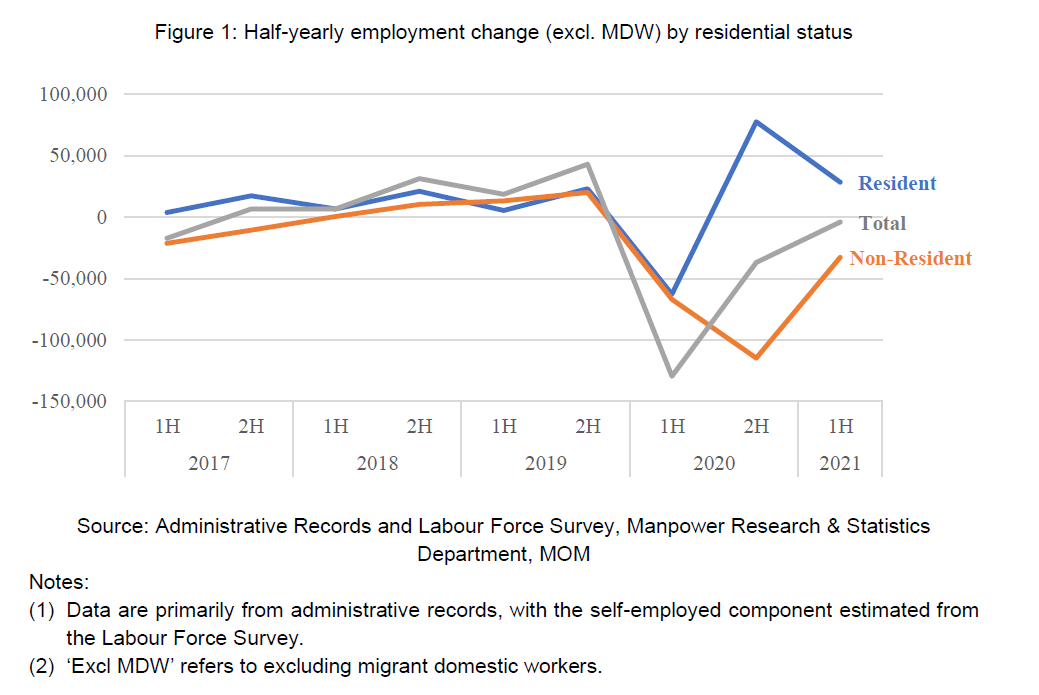

2. While resident employment increased in the first half of 2021 (1H 2021: 28,500), non-resident2 employment declined (-32,600, excluding Migrant Domestic Workers (MDW)) amid on-going border restrictions. As a result, total employment (-4,0003, excluding MDW) fell in 1H 2021.

3. Although resident employment increased across many sectors, led by Information & Communications, Health & Social Services, Professional Services, Public Administration & Education and Financial & Insurance Services, it declined in sectors adversely affected by Phase 2 (Heightened Alert) restrictions in 2Q 2021. These include consumer-facing Food & Beverage Services and Retail Trade, as well as tourism-related Arts, Entertainment & Recreation and Accommodation.

4. Non-resident employment declined across all sectors and pass types (Work Permit & Other Work Passes: -12,600; EP:-10,100; and S Pass: -9,800), due to tightened travel restrictions.

5. Seasonally adjusted unemployment rates continued their downtrend in June 2021 (Overall: 2.7%; Resident: 3.5%; Citizen: 3.7%).4 The resident long-term unemployment rate also dipped to 0.9% in June 2021 (seasonally adjusted), from highs recorded in December 2020 and March 2021 (1.1%). Notwithstanding these improvements, the unemployment and long-term unemployment rates remain elevated.

6. In 1H 2021, there were 4,620 retrenchments, or 2.3 retrenchments among every 1,000 employees. These were comparable to the half-yearly levels seen in 2018/2019. Quarterly, the number of retrenchments rose slightly from 1Q 2021 (2,270) to 2Q 2021 (2,340) amid the Phase 2 (Heightened Alert) measures.

7. More employees, particularly those in Food & Beverage Services, were placed on short work-week or temporary layoff in 2Q 2021 (5,580 from 4,020 in 1Q 2021). While the number remained elevated compared to pre-pandemic times, the prevalence of such temporary work arrangements helped to keep retrenchments relatively low in 1H 2021.

8. Following improvements in 4Q 2020 and 1Q 2021, the six-month re-entry rate among retrenched residents dipped slightly in 2Q 2021 (from 66% to 64%).

9. The on-going border restrictions have affected the availability of manpower in Construction and Manufacturing. There was also sustained demand in growth sectors like Financial & Insurance Services, Professional Services and Information & Communications. The number of job vacancies (seasonally adjusted) rose to an all-time high of 92,100 in June 2021. As the number of unemployed persons also declined, the ratio of job vacancies to unemployed persons improved to above 1 for the first time since March 2019. In June 2021, there were 163 job openings for every 100 unemployed persons.

Labour Market Outlook

10. Domestic and border restrictions are expected to be eased progressively as our vaccination rate continues to rise. This should raise employment levels and progressively reduce unemployment rates. However, we should expect the labour market recovery to be uneven across sectors as uncertainties in the external economic environment remain.

11. In particular, tourism- and aviation-related sectors are projected to see a slow recovery as travel restrictions globally are likely to be lifted cautiously and global travel demand may also remain sluggish amidst the spread of more contagious strains of the virus. Activity in these sectors is expected to remain significantly below pre-COVID levels even by the end of the year. Consumer-facing sectors such as Food & Beverage Services and Retail Trade should start to recover as domestic restrictions are eased over the course of the year, but they are also not expected to return to pre-COVID levels due to the subdued tourism outlook. By contrast, the growth prospects for outward-oriented sectors remain strong given the rebound in global demand. These include the Manufacturing, Wholesale Trade, Information & Communications, and Financial & Insurance Services sectors.

Conclusion

12. The Phase 2 (Heightened Alert) measures had some impact on the labour market in the second quarter of 2021. Nonetheless, the labour market has largely continued its gradual recovery although it has not fully returned to pre-COVID conditions. We expect labour market recovery to continue for the second half of the year, but in an uneven manner across sectors.

13. The Government and tripartite partners will continue to support employers and workers to emerge stronger from COVID-19 through the SGUnited Jobs and Skills Package.

-

The Jobs Growth Incentive (JGI) provides significant support for employers to expand local hiring. From September 2020 to February 2021, 42,000 JGI-eligible employers hired a total of more than 270,000 locals. The JGI was extended to end-September 2021 to benefit more employers and jobseekers. Employers hiring eligible locals can receive up to $15,000 per hire. Those hiring mature workers, persons with disabilities, and ex-offenders can receive more support, with effect from 1 March 2021, of up to $54,000 per hire.

-

To support employers to hire and reskill mid-career jobseekers for new jobs, the Career Conversion Programmes (CCPs) provide substantial training and salary support. Workforce Singapore offers close to 100 CCPs across about 30 sectors.

-

Employers can tap on the Support for Job Redesign under the Productivity Solutions Grant (PSG-JR) to redesign and improve jobs in order to attract and retain local workers.

-

The SGUnited Traineeships and SGUnited Mid-Career Pathways programmes also remain available for employers that are at present unable to hire new workers but have the intention to do so later. Jobseekers who have not yet found a job can make use of these programmes to acquire industry-relevant skills and experience and put themselves in a stronger position to seize new opportunities.

-

Jobseekers can find support through multiple channels. Jobseekers who require career matching services can approach WSG and NTUC’s Employment and Employability Institute, including through any of the 24 SGUnited Jobs & Skills Centres across the country. Mature, long-term unemployed, or persons with disabilities can be assisted by Adecco, our appointed SGUnited Jobs and Skills Placement Partner, to explore job opportunities.

For More Information

14. The “Labour Market Report Second Quarter 2021” is released by the Manpower Research and Statistics Department, Ministry of Manpower. The report and technical notes on the various indicators are available at http://stats.mom.gov.sg/Pages/Home.aspx.