5 benefits our CPF system has over other pension systems

If you’ve wondered how CPF measures up with other countries’ pension systems

The CPF, or Central Provident Fund, is a social security scheme funded by contributions from both employers and employees.

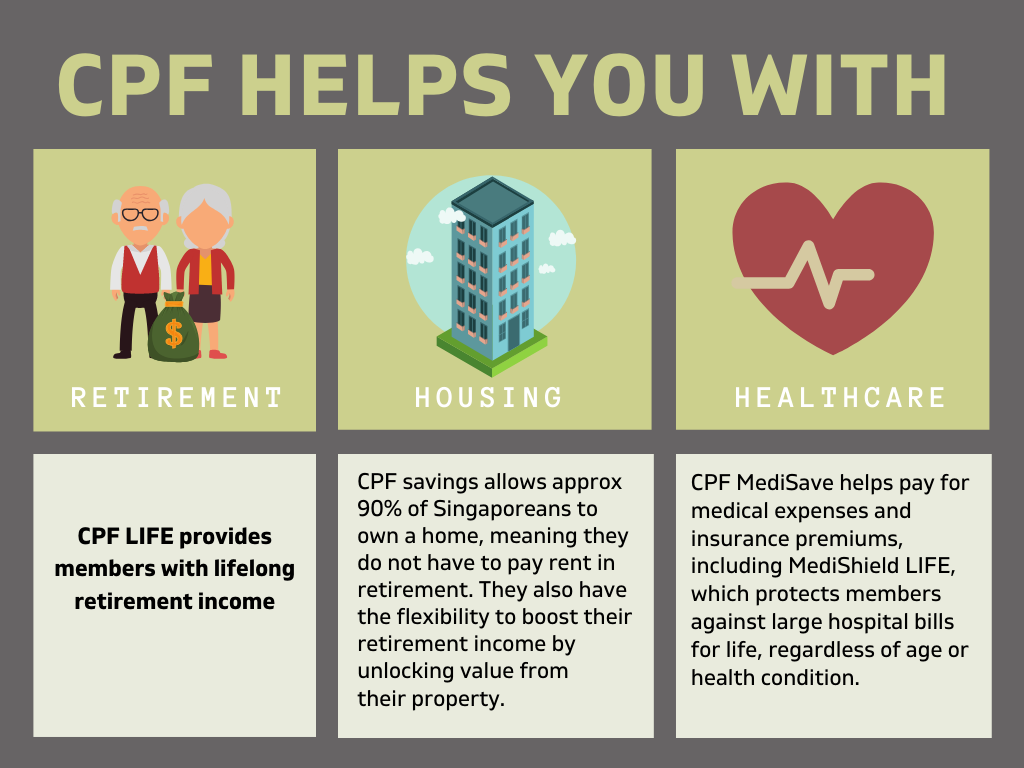

It helps Singaporeans set aside savings for retirement, as well as for other important things like housing and healthcare.

What sets the CPF apart from other pension systems? Here are 5 considerations.

1. CPF is a 3-in-1 system

Unlike pension systems in other countries, the CPF goes beyond providing members with an income in retirement. The CPF also helps us to save for housing and healthcare

2. CPF provides attractive, risk-free returns

CPF members earn government-guaranteed interest of up to 6% per annum on their savings.

In comparison, other defined-contribution pensions systems require members have to take on some investment risks to grow their savings.

3. CPF is sustainable. Payouts depend on the savings set aside by each member.

The savings required to meet retirement needs differ from person to person. To help provide for basic retirement expenses, CPF members can set aside the Basic Retirement Sum (BRS), which takes reference from the actual spending of retiree households.

To get higher CPF payouts, you can:

- Top up your CPF; or

- Defer starting your retirement payouts.

Unlike the CPF, many other pension systems are funded by taxpayers. Given rapidly ageing populations and the challenges in reducing pension benefits or deferring pension payout ages, these systems run the risk of default or insolvency.

4. Singaporeans do not rely on individual CPF contributions alone for their retirement income.

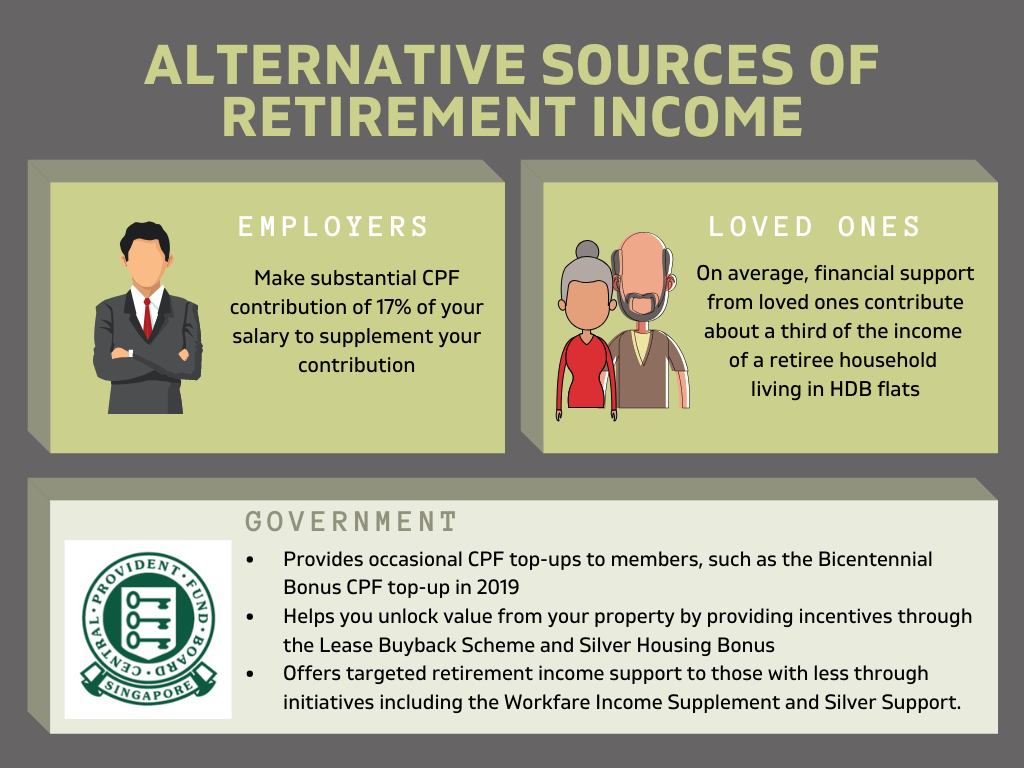

Aside from your contribution of 20% of your salary to CPF, your individual efforts are supplemented by your employers, loved ones and the Government.

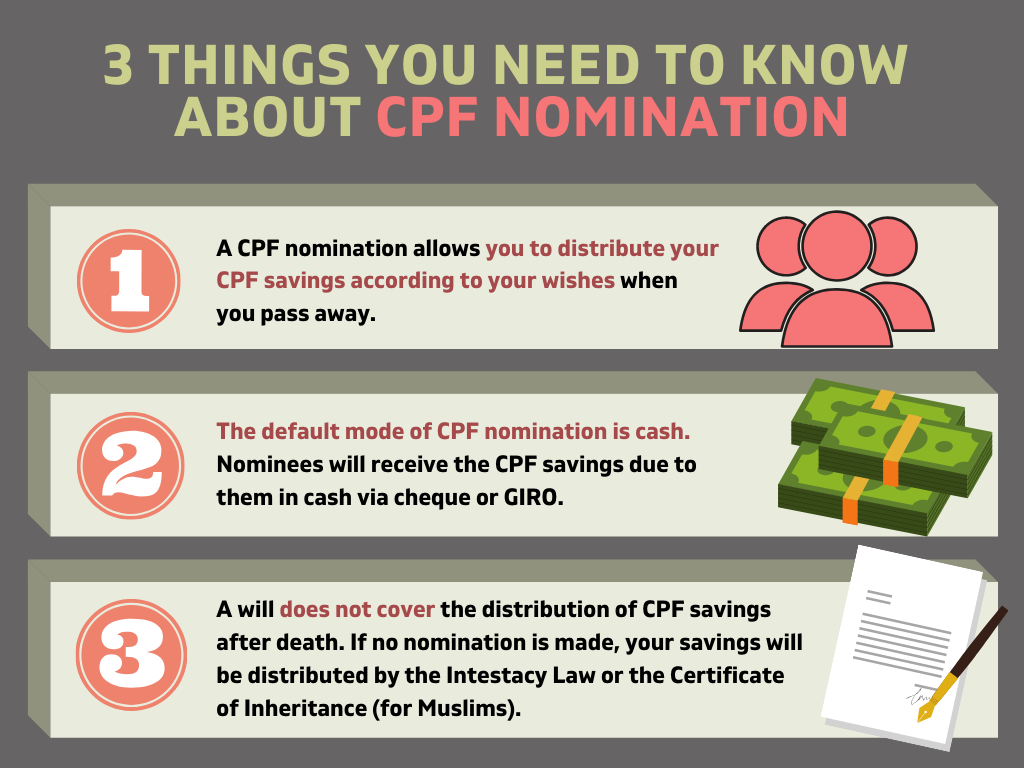

5. When you pass on, any unused CPF monies are distributed to your nominees and/or loved ones.

Most tax-funded pension systems stop payments upon members’ death, so not all of a member’s contributions will be paid out to them or their loved ones.

In addition, there are several Government schemes that can help support expenses in retirement:

Lease Buyback Scheme: Elderly flat owners can sell part of their flat’s lease back to HDB to receive a stream of retirement income while continuing to live in their flat.

The Silver Housing Bonus: Provides elderly Singapore households with a cash bonus when they right-size to a 3-room or smaller flat, which will be used to top up their CPF Retirement Account and to join CPF LIFE.

Workfare Income Supplement: Provides cash payouts and CPF top-ups to lower-wage Singaporean workers.

Silver Support Scheme: Provides a quarterly cash payout to elderly Singaporeans aged 65 and above, who had low incomes through life and who now have little or no family support.

ComCare Long-Term Assistance: Provides a cash sum each month to destitute persons who cannot work permanently as a result of old age or illness and have little or no family support.

For more information on CPF, go to www.cpf.gov.sg