Statement on Labour Market Developments

Introduction

- In the first half of 2014, the Ministry of Manpower (MOM) maintained its approach of taking progressive steps to raise the quality of our foreign workforce and reduce reliance on foreign labour, in line with the Government’s efforts to achieve quality economic growth driven by sustained productivity improvement. MOM implemented previously-announced foreign workforce measures1; with no new tightening measures announced in the recent Budget, except for measures focused on the Construction sector. These measures have contributed to the slowing foreign workforce growth, which is now at a more sustainable pace.

- MOM is guided by the following considerations in calibrating labour market policy: (i) a sustainable rate of labour force growth; (ii) real income growth for a broad base of Singaporeans; (iii) productivity growth; and (iv) the economic outlook.

Review of First Half of 2014

Employment

Unemployment remained low

- The unemployment rate remained low and stable amid the tight labour market. The seasonally-adjusted citizen unemployment rate was 2.9% in June 2014, and remained comparable to the levels since the start of 2011. The resident long-term unemployment2 remained low, and amongst the lowest globally, at 0.6% p in June 2014.

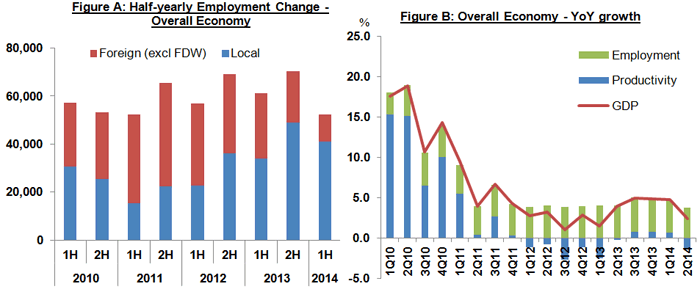

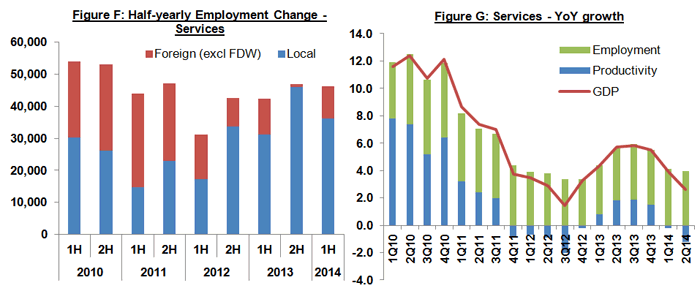

Foreign employment growth slowed, leading to moderation of total employment growth

- Total employment growth in 1H 2014 moderated to 52,200 excluding Foreign Domestic Workers (FDW), down from 61,100 in 1H 2013, translating to a lower year-on-year growth of 3.8% in June 2014, compared to 4.2% a year ago. This was largely driven by the slowdown in foreign employment growth (11,200), which was less than half for the same period in 2013. In particular, foreign employment growth in 2Q 2014 (3,800) registered the lowest quarterly growth since 3Q 2009 (700). The Construction sector accounted for half of the 1H 2014 growth in foreign employment, due to infrastructure projects such as the Downtown and Thomson MRT lines.

Hiring of locals remained strong

- Local employment growth remained strong at 41,000 (4.2% year-on-year growth in June 2014), supported by the increased labour force participation rate of women and older residents3. The Services sector was the main driver of employment growth, accounting for almost 9 of 10 jobs created.

Income

Broad-based income growth for Singaporeans expected to continue

- In 2013, the real median gross monthly income from work (including employer CPF contributions) of full-time employed citizens increased by 4.6%4. From 2008 to 2013, stronger real income growth at the 20th percentile (P20) led to a narrowing of the gap between median and P20 incomes5. In the tight labour market, wages are expected to continue to rise6 in a broad-based manner. However, these wage increases can only be sustained in the long-term through productivity growth.

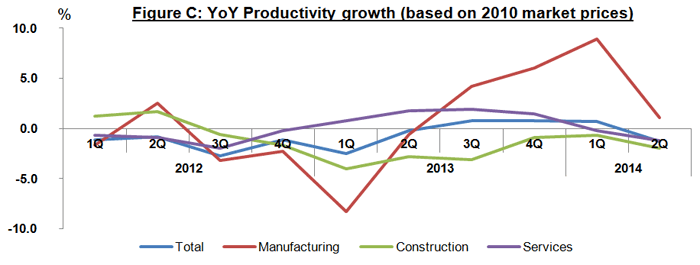

Productivity

Domestic-oriented services continued to lag in productivity growth, while the Manufacturing sector sustained positive growth

- Labour productivity growth in 2Q 2014 was -1.3%, after three successive quarters of positive growth. For 1H 2014, labour productivity fell by 0.3% year-on-year, an improvement from the decline of 1.3% in the same period last year but a decline from the positive 0.8% growth in 2H 2013. Excluding Construction, productivity growth was at 0.1% in 1H 2014. The Manufacturing sector sustained four quarters of positive growth, likely reflecting a shift towards higher value-added activities. However, domestic-oriented industries within the Services sector – such as food services, retail trade, and accommodation – continued to lag.

Sectoral Performance and Outlook

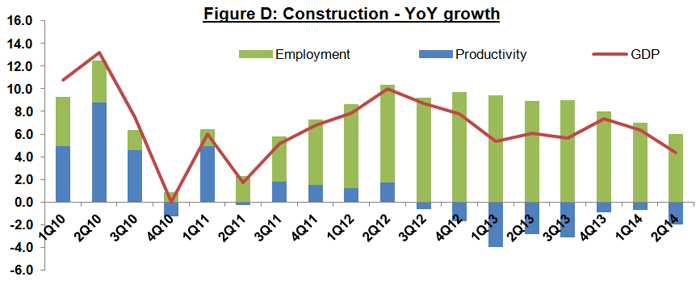

Construction

- Employment growth in the Construction sector slowed significantly in 1H 2014 (9,100) compared to the preceding period (2H 2013: 18,300) and the same period a year ago (1H 2013: 16,900). However, Construction sector GDP growth also moderated over the period, and as a result, construction productivity remained negative in 1H 2014.

- Construction Outlook. The Construction sector is expected to remain a significant driver of foreign employment growth amidst continued strong sector demand, including public infrastructure projects. Policy measures such as the foreign worker levy increases announced in March 2014 will encourage the sector to improve productivity and moderate employment growth. Firms will be further incentivised to retain and rely more on experienced, higher-quality workers.

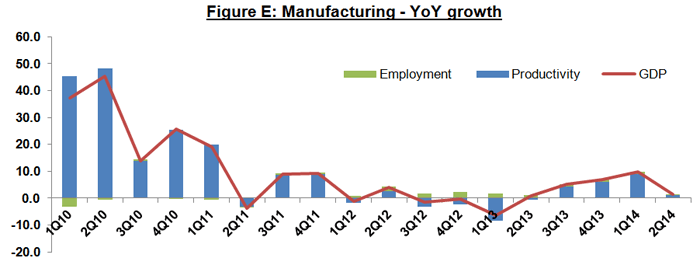

Manufacturing

- Employment in the Manufacturing sector fell in 1H 2014 (-3,500), due primarily to a decline in foreign employment (-4,700). Productivity in the Manufacturing sector has been positive since 3Q 2013, although strong first quarter productivity growth of 8.9% moderated to 1.1% in 2Q 2014 as Manufacturing GDP growth slowed.

- Manufacturing Outlook. The hiring outlook for the rest of 2014 for the Manufacturing sector remains modest compared to other sectors, although we expect to continue to see vacancies for occupations such as engineers and engineering technicians. The marine industry is also expected to recruit due to a global interest in offshore oil exploration which is driven by high oil prices.

Services

- The Services sector continued to be the main driver of total employment growth, with Singaporeans making up the majority of growth. 1H 2014 total employment growth (46,300) edged up from a year ago (1H 2013: 42,400). In particular, the community, social and personal services, and administrative & support services industries experienced the strongest employment growth in 1H 2014. After a full year of positive growth, Services productivity growth was negative in 1H 2014 (-0.7%).

- Services Outlook. The labour market for the Services sector is expected to remain tight for the second half of the year, especially given the upcoming festive season. Certain domestic consumer services industries such as food services, retail trade and accommodation will face supply-side constraints as the previously announced Dependency Ratio Ceiling (DRC) reduction to 45% took full effect on 1 July 2014. In response, some firms in these industries have started to restructure their operations to streamline processes and reduce manpower reliance. This is a positive development that needs to be sustained and made more broad-based, as it will put these firms in good stead to operate in a tight labour market.

Overall Labour Market Outlook for 2014

- Overall, the Singapore labour market is expected to remain tight for the rest of 2014. The Ministry of Trade and Industry (MTI) expects the Singapore economy to grow by 2.5 – 3.5% in 2014, with growth in 2H 2014 likely supported by externally-oriented sectors such as wholesale trade, and finance and insurance.

- Services demand will continue to be a major contributor to employment growth, while demand for lower-skilled foreign employment in the Construction sector will also remain strong. However, labour supply will remain tight and will be felt more keenly by the more labour intensive industries such as food services, retail trade and accommodation, where demand will be driven by the impending opening of several hotels and shopping malls. These factors will place upward pressure on wages.

- The strong hiring of Singaporean workers is expected to continue this year, as a confluence of foreign workforce constraints, higher wages, and employers’ adoption of flexible work arrangements attract more women and older workers into the labour force. The resident labour force participation rate rose to 66.7% in 2013, with further increases expected in 2014.

- Overall productivity growth is expected to remain uneven. Productivity growth in the Manufacturing sector and certain externally-oriented Services industries is expected to be offset by the Construction sector and some of the more domestic-oriented Services industries.

Conclusion

- MOM will continue to closely monitor how firms are adjusting to the tight labour market conditions and previously announced foreign workforce measures. While the growth in foreign employment continued to slow, productivity growth remains uneven across sectors. Labour demand will continue to be firm, as hiring expectations remain robust.

- The manpower-lean environment will continue to be a feature of the Singapore economy. The key to firms coping with tighter labour market conditions and sustaining higher wages is through productivity growth. More needs to be done to raise productivity, most critically in the Construction sector, as well as the more manpower-intensive industries within the Services sector. The Government is studying further measures to improve the quality of the Construction workforce.

- The Government will continue to help businesses grow and succeed here to create quality jobs for Singaporeans. As the economy restructures, some consolidation and exit of less-productive businesses is expected. MOM and the Workforce Development Agency (WDA) stand ready to help displaced local workers re-skill and upgrade so that they are positioned to take on the new jobs created.

p Provisional

1 This included the: i) progressive increase in foreign worker levies for both S Pass and Work Permit Holders for all sectors; ii) increase in minimum qualifying salaries for Employment Pass, and iii) continued implementation of Services sector Dependency Ratio Ceiling reduction to 40%.

2 Refers to long-term unemployed residents (i.e. those unemployed for at least 25 weeks) as a percentage of economically active residents.

3 Labour Force Participation Rate (LFPR) of residents aged 65 and over increased steadily from 16.1% in 2008 to 23.8% in 2013. LFPR of female residents increased from 55.6% in 2008 to 58.1% in 2013.

4 When adjusted using Consumer Price Index (CPI) All-items less imputed rentals on owner-occupied accommodation (which have no impact on the cash expenditure of households who are owner-occupiers), real median income growth was 5.2% in 2013.

5 Real annualised income from 2008 to 2013 grew at 1.7% (median) and 2.0% (P20).

6 Gross Monthly Income from work of full-time employed Singapore citizens in June 2014 will be published in the Employment Situation, 2014 in end-January 2015, and covered in the March 2015 Statement on Labour Market Developments.