Statement on Labour Market Developments

Introduction

- In 2014, the Ministry of Manpower (MOM) continued its policies to raise the quality of the workforce and support restructuring of the economy towards productivity-driven growth. These policy objectives continue to be relevant. It remains crucial for the Singapore economy to restructure towards reducing reliance on manpower. With the labour market expected to tighten further as local employment growth slows, businesses should step up efforts to adopt less labour-intensive practices.

Review of 2014

- MOM is guided by the following considerations in calibrating labour market policy: (i) a sustainable rate of labour force growth; (ii) real income growth for a broad base of Singaporeans; (iii) productivity growth; and (iv) the economic outlook.

Employment

Unemployment remained low and job vacancies increased

- The unemployment rate remained low amid the tight labour market. For the whole of 2014, the annual average unemployment rate for citizens was 2.9%, unchanged from 2013.1 The ratio of job vacancies to unemployed persons increased to 1.39 in 2014 from 1.29 in 2013, reflecting the continued availability of jobs for those seeking employment.2

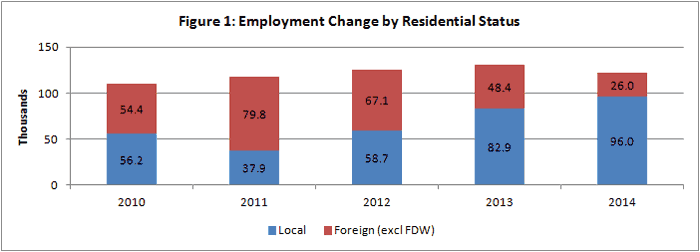

Local hiring was strong in 2014, while foreign employment growth continued to moderate

- Despite the steady moderation of foreign workforce growth, total employment in 2014 remained strong, growing by 122,100 excluding Foreign Domestic Workers (FDW) or 3.7%.3 This was slightly lower than the 131,300 (4.2%) growth in 2013. Total employment growth was driven largely by strong local4 employment growth (96,000 or 4.4% in 2014, up from 82,900 or 4.0% in 2013), with more women and older locals participating in the labour market. 73.8% of total job creation in 2014 went to locals. However, the recent gains in labour force participation cannot continue at the same pace, and local employment growth is expected to slow considerably over the rest of the decade (Refer to the Annex for more details).

- Foreign employment growth (excluding FDW) moderated for the third consecutive year to 26,000 (or 2.4%) in 2014, down from 48,400 (or 4.6%) in 2013 owing to several factors, including ongoing foreign manpower tightening measures. The bulk of foreign employment growth came from the Services sector (21,500), as foreign employment in the Construction sector slowed to 9,700 in 2014, compared to 31,600 in 2013, due to slower construction output growth.

Income

Broad-based income growth for Singaporeans

- In 2014, the real monthly income5 (including employer CPF contributions) of full-time employed citizens increased over the year at the median by 1.4% and at the 20th percentile by 2.1%.6 Real income growth has been broad-based and sustained over the last 5 years, growing by 2.1% per annum at the median and 1.5% per annum at the 20th percentile.7 Going forward, the tight labour market will continue to place upward pressure on wages. However, these wage increases can only be sustained in the long-term through productivity growth.

Productivity

Labour productivity growth remained weak

- Overall labour productivity declined by 0.8% in 2014, as employment gains continued to outstrip GDP growth.8 The decline is attributed to falling productivity across most sectors, and a rise in the employment share of less productive, domestically-oriented sectors such as Food & Beverage services and Construction. Only Manufacturing and Financial & Insurance services registered an increase in labour productivity over the whole of 2014.

Sectoral Performance and Outlook

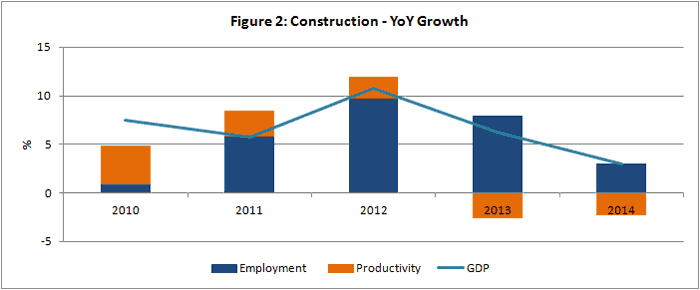

Construction

- Total employment growth in the Construction sector slowed significantly in 2014 (14,300) compared to previous years (35,200 in 2013 and 39,100 in 2012). This was due to a moderation in output growth in 2014 rather than to productivity gains, as construction productivity continued to decline in 2014. There remains a pressing need for productivity gains in the sector, which will be supported by measures to encourage firms to hire and retain more productive, higher skilled R1 workers.9

- The Construction sector is expected to remain a significant driver of foreign employment growth in 2015. However, the temporary deferment of public sector projects and softer private sector demand is likely to slow down the pace of employment growth.

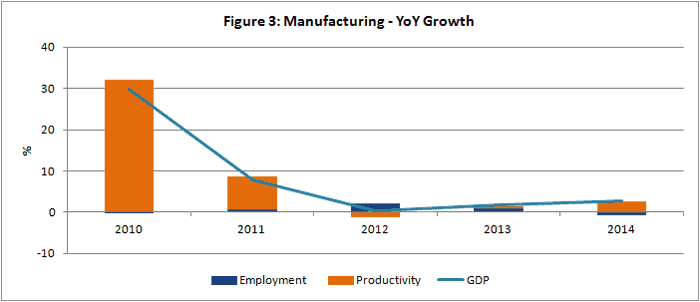

Manufacturing

- Labour productivity in Manufacturing improved by 2.5% as manufacturing GDP expanded at a faster pace in 2014 (2.6% compared to 1.7% in 2013), coupled with negative total employment change (-4,400) in the sector. This was mostly due to a contraction in foreign employment in the Process and Marine industries after the completion of several large-scale projects.

- The hiring outlook for the sector in 2015 is expected to be modest. Notably, lower global oil prices could affect employment growth in certain segments such as the Transport Engineering cluster.

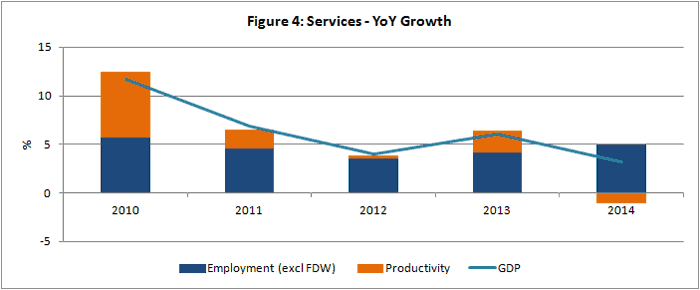

Services

- Services accounted for most of the employment growth in 2014. Total employment (excluding FDW) in Services increased by 111,700 over the year compared to 89,300 in 2013. Employment of locals in the sector grew by 90,100 in 2014 higher than the 77,100 in 2013. Foreign employment growth in 2014 also increased from 12,100 in 2013 to 21,500 in 2014. Services productivity turned negative as employment growth outpaced GDP growth.

- Employment demand in the Services sector is expected to remain strong and be the major contributor to employment growth in 2015. In particular, the Wholesale & Retail Trade, Business Services, and Community, Social & Personal Services industries should see high demand for manpower. It is crucial for firms in this sector to prioritise productivity improvements and adopt more skills- and capital-intensive approaches.

Overall Labour Market Outlook for 2015

- The labour market in Singapore is expected to remain tight in 2015. The Ministry of Trade and Industry (MTI) expects the Singapore economy to grow by 2% to 4% in 2015.

- Labour demand will remain high this year, with the Services sector expected to be a major contributor to employment growth. With labour supply remaining tight, there is likely to be upward pressure on wages in labour-intensive sectors such as Construction, Retail, and Food Services. Wage increases cannot be sustained in the long-run without productivity improvements. Continued efforts to improve labour productivity should remain a primary focus across all sectors.

Conclusion

- During the last two years of economic restructuring, employers have been able to meet their manpower needs by hiring locals in larger numbers. This is evident in the strong employment growth, with local employment growing by 82,900 in 2013 and 96,000 in 2014, amidst foreign employment growth (excluding FDW) slowing from 48,400 in 2013 to 26,000 in 2014. The growth in local employment is a positive development and has contributed to better employment outcomes for locals.

- The recent jump in local workforce growth in the last 2 years to meet labour demand is likely to taper significantly going forward. Our demographic realities mean that for the second half of this decade, the growth in the working-age population will slow. Recent gains in labour force participation rates cannot continue at the same pace. Local employment growth is therefore expected to slow considerably, averaging 20,000 a year in the last part of this decade (refer to Annex for further details).

- At the same time, given Singapore’s physical and social constraints, foreign manpower policies will remain tight to maintain growth at a sustainable pace. Consequently, employers will find it harder and more costly to hire workers, local or foreign, to meet their manpower needs.

- Given the dynamics ahead in our labour market, firms have to shift towards more skills- and capital-intensive ways to grow. They will need to focus on the quality, not quantity, of the workforce as a key source of growth, productivity and competitiveness. This will require not just automating tasks and improving processes, but also making significant investments in the skills and development of their employees. The window to make such changes is narrowing, and it is crucial for businesses to adjust in order to survive and thrive in the new normal of slower workforce growth.

1 The annual average unemployment rate for residents was 2.7% for the whole of 2014, compared to 2.8% in 2013. Source: Labour Market, 2014, MOM.

2 Seasonally Adjusted.

3 Employment data are sourced from Labour Market 2014, MOM.

4 Refers to Singapore Citizens and Permanent Residents.

5 Data on gross monthly income from work of full-time employed citizens are sourced from Labour Market 2014, MOM.

6 Real gross monthly income for full-time employed residents increased over the year by 0.7% at the median and 3.6% at the 20th percentile in 2014.

7 Deflated by Consumer Price Index – All Items at 2014 prices.

8 GDP at 2010 prices.

9 Announced measures include the minimum R1 requirement in 2017, widening of R1 and R2 (Basic Skilled) levy differential from July 2015, and introduction of new direct R1 pathway from September 2015.